When you check your payslip or do your tax return, you’ll see that you have a tax code, made up of mysterious numbers. But what do they mean and why is it important that you check yours? Here’s everything you need to know about tax codes.

Everyone has a tax code

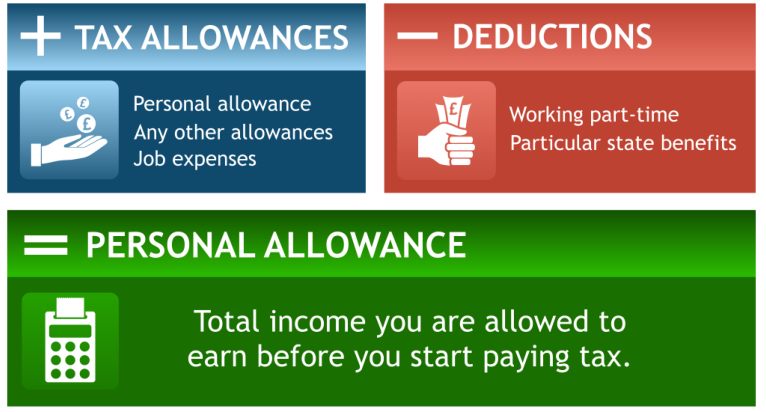

Your tax code shows information about your earnings and taxation status, with the numbers representing different pieces of information. Everyone has a tax code when they are an adult. For most people with just one job, their tax code is 1257L. The first number relates to the personal allowance that most working people are entitled to, which is currently at £12,750 for the current tax year 23/24.

What your tax code is used for

Your tax code is used for self-assessment, by your employer or by your pension provider to tell them how much tax you need to pay. Gloucester accountants such as www.randall-payne.co.uk/services/accountancy/gloucester-accountants/ can give information about your specific tax code and advice about whether or not it is correct.

How to find your own tax code

You can log into your own tax account via HMRC, use the HMRC app or look at your wage slip to see what your tax code is.

It’s important to check your tax code

Your tax circumstances can change so it’s important to check your tax code regularly to ensure you’re still on the correct one. If you aren’t, then contact HMRC to notify them. This is important as otherwise, you could end up overpaying or underpaying tax.

If you have an incorrect or uncertain tax status, you may have to pay emergency tax under an emergency tax code. This can then be reclaimed, but it’s far easier to check your tax code in advance and to make sure that it’s accurate.